29 Jun How to read your Credit Report

Hopefully this guide “how to read your credit report” will help you get a better understanding of your report and score.

Checking your Credit Score before you apply for a mortgage can give you an idea of how lenders may see you, based on information in your Credit Report. It can also help you work out if you need to improve your credit history, before making your mortgage application.

There is not a specific credit score you need for a mortgage. There is more to getting a mortgage that your credit score.

When you make an application for a mortgage or other type of credit, lenders work out a credit score for you. This is to help them decide if you will be a risk worth taking. The will use your report to see if you are a responsible, reliable borrower and likely to repay the debt. Usually, a higher score means you are lower risk. The more points you score, the more chance you have of being accepted for a mortgage, and at better rates.

What can your Credit Score tell you?

The credit score you need to get a mortgage varies. There is not a magic credit score. However, if you have a good credit score with a credit agency it is likely that you will have a good credit score with a lender.

Who provides a credit score?

¬There are three major credit reporting bureaus, there are: Experian, Equifax, and TransUnion. All these agencies provide credit reports though formats vary. We do not recommend any agency but will use Experian for our examples.

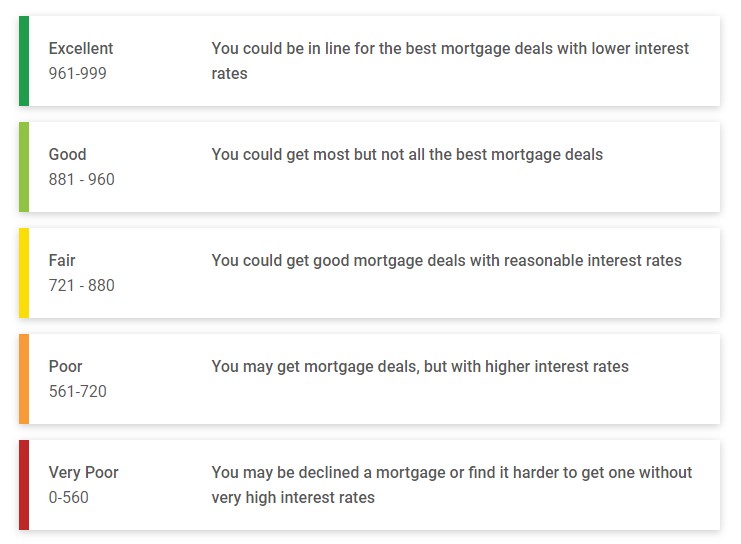

What is a good credit score for a mortgage?

Well, for example Experian’s Credit Score is based on the information in your Credit Report. The score runs from 0-999. Your score can give you a good idea of how lenders are likely to view you. The higher your score, the better the chance you have of getting the mortgage you want.

Public Record Information

This part of your credit file shows any court orders, Individual Voluntary Arrangements (IVAs), Debt Relief Orders or Trust Deeds, Bankruptcy or Sequestration.

An IVA will appear on the credit report for six years, starting from the date it was approved. This record will be marked as ‘complete’ if you have paid it off early.

A Debt Relief Order (DRO) / Trust Deed (Scotland) will also appear on the credit report for six years.

A county court judgement (CCJ) (England & Wales) or a Sheriff Court Decree (Scotland) is a court order that might be registered against you if you fail to repay money you owe. Court judgements are held on record for six years. If the amount of the judgement is paid within one month, it is removed from their record. If it is paid after one month, it stays on the record for six years, but it will show as being settled.

Bankruptcy (Sequestration in Scotland) will appear on the credit report for six years, or until it is discharged if this takes longer.

Credit Accounts

This section shows specific information on each credit account opened, including status and any past due information. Creditor contact information is provided in the report to make it easier to resolve any issues.

For open accounts, positive information will remain on the credit report if the account is open and active.

Status codes

Every credit account has a list of status codes which show whether you have made your credit repayments over the past 6 years.

Credit Reference Agencies can provide payment history over the last 72 months. The most recent balance to the left along with the latest status code of the account.

Status codes key

- 0 – payments up to date

- 1 – payments up to 1 month late

- 2 – payments up to 2 months late

- 3 – payments up to 3 months late

- 4 – payments up to 4 months late

- 5 – payments up to 5 months late

- 6 – payments are 6 months or more late

- 8 – If your account is in default, this is shown as either the warning triangle or an 8

- U is Unknown and means that the lender cannot give an account status for this month.

- D is Dormant meaning the account is not being used and nothing is owed

What if my mortgage credit check was poor?

If you have bad credit it does not mean you cannot get a mortgage. It may be harder to get the deal you want, and you might need a higher deposit, or you might pay a higher rate of interest.

Many people simply have a low credit score because of their life situation, a short credit history for example.

Mortgage lenders like to know if you can keep up to date with your monthly payments. So, showing them you can manage credit cards, mobile phone contracts and even some utility services might boost your credit score.

Improve your credit score for a mortgage application

One of the most important things you can do is to make credit payments on time. Not only does it save on charges, but it also stops you getting missed or late payments on your credit report.

We have more guides available for first time buyers, home buyers, remortgages and buy to let.

We also recommend The Money Advice Service if you want more detailed information.

Guides: